ManPageW Bank

Enjoy it, and help to fill it! But please, always respecting copyright.

Please write your contributions under the Contributions Section

Contents

Window: Bank

Description : Maintain Bank

Help : The Bank Window is used to define the banks and accounts associated with an organization or business partner

Tab: Bank

Description : Maintain Bank

Help : The Bank Tab defines a bank that is used by an organization or business partner. Each Bank is given an identifying Name, Address, Routing No and Swift Code

Table Name : C_Bank

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name

NVARCHAR2(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Address | Location or Address | The Location / Address field defines the location of an entity. | C_Location_ID

NUMBER(10) Location |

| Own Bank | Bank for this Organization | The Own Bank field indicates if this bank is for this Organization as opposed to a Bank for a Business Partner. | IsOwnBank

CHAR(1) YesNo |

| Routing No | Bank Routing Number | The Bank Routing Number (ABA Number) identifies a legal Bank. It is used in routing checks and electronic transactions. | RoutingNo

NVARCHAR2(20) String |

| Swift code | Swift Code or BIC | The Swift Code (Society of Worldwide Interbank Financial Telecommunications) or BIC (Bank Identifier Code) is an identifier of a Bank. The first 4 characters are the bank code, followed by the 2 character country code, the two character location code and optional 3 character branch code. For details see http://www.swift.com/biconline/index.cfm | SwiftCode

NVARCHAR2(20) String |

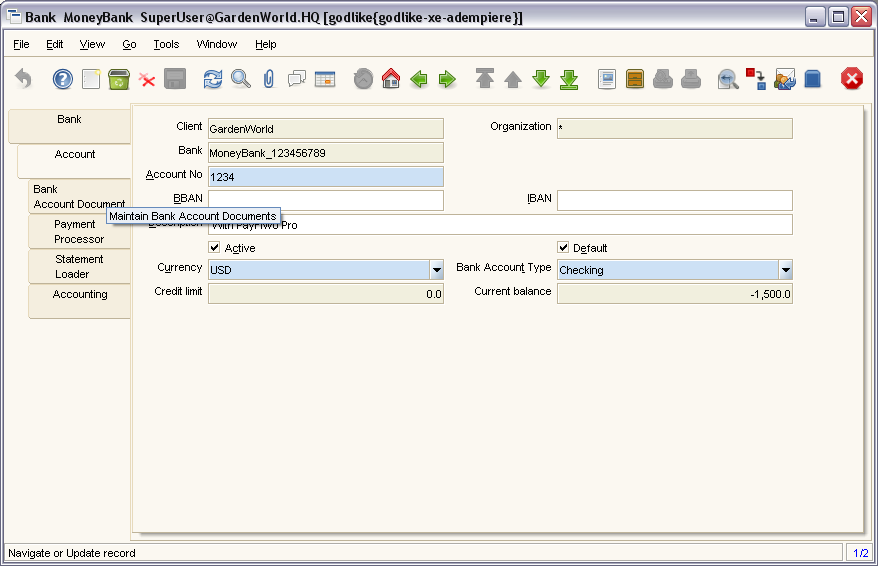

Tab: Account

Description : Maintain Bank Account

Help : The Account Tab is used to define one or more accounts for a Bank. Each account has a unique Account No and Currency. The bank account organization is used for accounting.

Table Name : C_BankAccount

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Bank | Bank | The Bank is a unique identifier of a Bank for this Organization or for a Business Partner with whom this Organization transacts. | C_Bank_ID

NUMBER(10) TableDir |

| Account No | Account Number | The Account Number indicates the Number assigned to this bank account. | AccountNo

NVARCHAR2(20) String |

| BBAN | Basic Bank Account Number | The Basic (or Domestic) Bank Account Number is used in Bank transfers (see also IBAN). For details see ISO 13616 and http://www.ecbs.org/ | BBAN

NVARCHAR2(40) String |

| IBAN | International Bank Account Number | If your bank provides an International Bank Account Number, enter it here

Details ISO 13616 and http://www.ecbs.org. The account number has the maximum length of 22 characters (without spaces). The IBAN is often printed with a apace after 4 characters. Do not enter the spaces in Adempiere. |

IBAN

NVARCHAR2(40) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Default | Default value | The Default Checkbox indicates if this record will be used as a default value. | IsDefault

CHAR(1) YesNo |

| Currency | The Currency for this record | Indicates the Currency to be used when processing or reporting on this record | C_Currency_ID

NUMBER(10) TableDir |

| Bank Account Type | Bank Account Type | The Bank Account Type field indicates the type of account (savings, checking etc) this account is defined as. | BankAccountType

CHAR(1) List |

| Credit limit | Amount of Credit allowed | The Credit Limit field indicates the credit limit for this account. | CreditLimit

NUMBER Number |

| Current balance | Current Balance | The Current Balance field indicates the current balance in this account. | CurrentBalance

NUMBER Number |

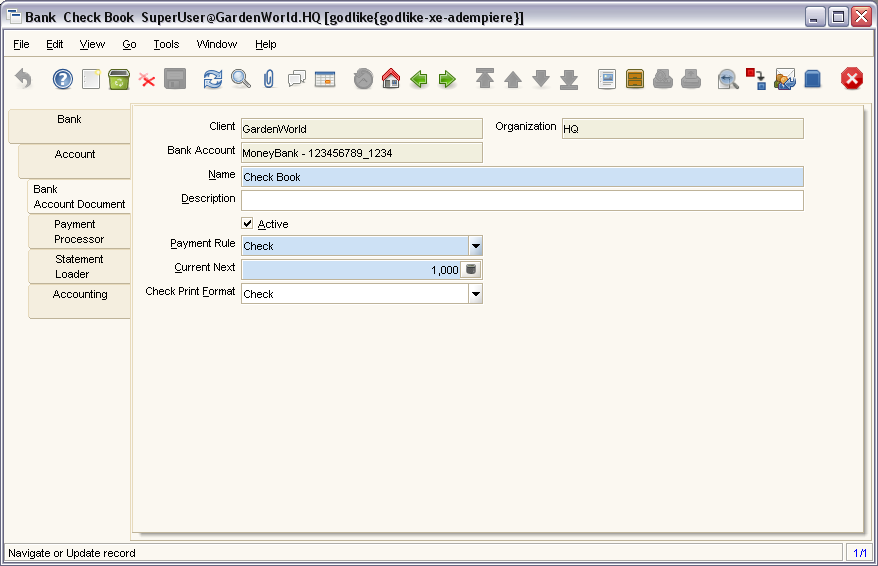

Tab: Bank Account Document

Description : Maintain Bank Account Documents

Help : In this tab, you define the documents used for this bank account. You define your check and other payment document (sequence) number as well as format.

Table Name : C_BankAccountDoc

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Bank Account | Account at the Bank | The Bank Account identifies an account at this Bank. | C_BankAccount_ID

NUMBER(10) TableDir |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name

NVARCHAR2(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Payment Rule | How you pay the invoice | The Payment Rule indicates the method of invoice payment. | PaymentRule

CHAR(1) List |

| Current Next | The next number to be used | The Current Next indicates the next number to use for this document | CurrentNext

NUMBER(10) Integer |

| Check Print Format | Print Format for printing Checks | You need to define a Print Format to print the document. | Check_PrintFormat_ID

NUMBER(10) Table |

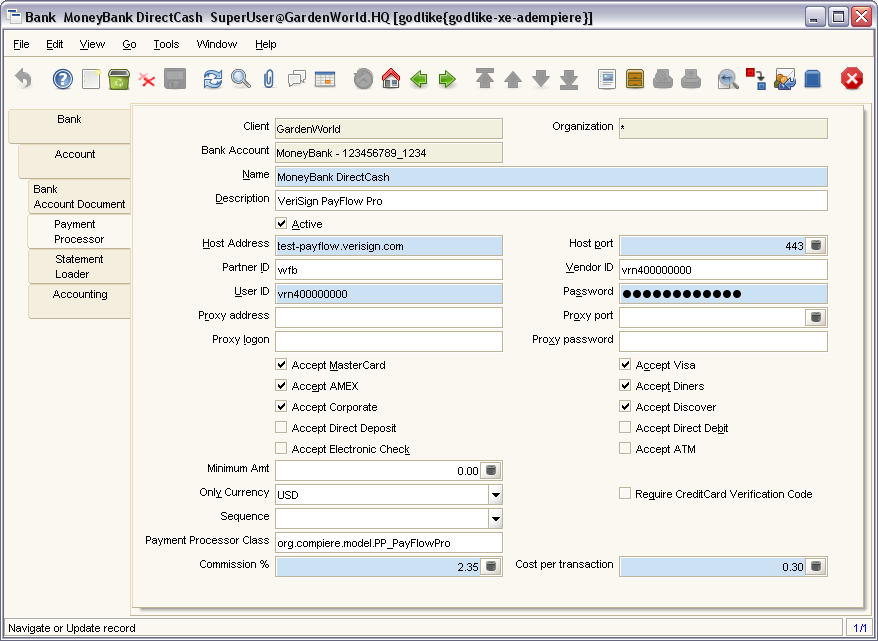

Tab: Payment Processor

Description : Processor for online payments

Help : The Electronic Payments Tab is used to define the parameters for the processing of electronic payments. If no currency is defined, all currencies are accepted. If a minumum amount is defined (or not zero), the payment processor is only used if the payment amount is equal or higher than the minumum amount.

The class needs to implement org.compiere.model.PaymentProcessor

Table Name : C_PaymentProcessor

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Bank Account | Account at the Bank | The Bank Account identifies an account at this Bank. | C_BankAccount_ID

NUMBER(10) TableDir |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name

NVARCHAR2(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Host Address | Host Address URL or DNS | The Host Address identifies the URL or DNS of the target host | HostAddress

NVARCHAR2(60) String |

| Host port | Host Communication Port | The Host Port identifies the port to communicate with the host. | HostPort

NUMBER(10) Integer |

| Partner ID | Partner ID or Account for the Payment Processor | Partner ID (Verisign) or Account ID (Optimal) | PartnerID

NVARCHAR2(60) String |

| Vendor ID | Vendor ID for the Payment Processor | VendorID

NVARCHAR2(60) String | |

| User ID | User ID or account number | The User ID identifies a user and allows access to records or processes. | UserID

NVARCHAR2(60) String |

| Password | Password of any length (case sensitive) | The Password for this User. Passwords are required to identify authorized users. For Adempiere Users, you can change the password via the Process "Reset Password". | Password

NVARCHAR2(60) String |

| Proxy address | Address of your proxy server | The Proxy Address must be defined if you must pass through a firewall to access your payment processor. | ProxyAddress

NVARCHAR2(60) String |

| Proxy port | Port of your proxy server | The Proxy Port identifies the port of your proxy server. | ProxyPort

NUMBER(10) Integer |

| Proxy logon | Logon of your proxy server | The Proxy Logon identifies the Logon ID for your proxy server. | ProxyLogon

NVARCHAR2(60) String |

| Proxy password | Password of your proxy server | The Proxy Password identifies the password for your proxy server. | ProxyPassword

NVARCHAR2(60) String |

| Accept MasterCard | Accept Master Card | Indicates if Master Cards are accepted | AcceptMC

CHAR(1) YesNo |

| Accept Visa | Accept Visa Cards | Indicates if Visa Cards are accepted | AcceptVisa

CHAR(1) YesNo |

| Accept AMEX | Accept American Express Card | Indicates if American Express Cards are accepted | AcceptAMEX

CHAR(1) YesNo |

| Accept Diners | Accept Diner's Club | Indicates if Diner's Club Cards are accepted | AcceptDiners

CHAR(1) YesNo |

| Accept Corporate | Accept Corporate Purchase Cards | Indicates if Corporate Purchase Cards are accepted | AcceptCorporate

CHAR(1) YesNo |

| Accept Discover | Accept Discover Card | Indicates if Discover Cards are accepted | AcceptDiscover

CHAR(1) YesNo |

| Accept Direct Deposit | Accept Direct Deposit (payee initiated) | Indicates if Direct Deposits (wire transfers, etc.) are accepted. Direct Deposits are initiated by the payee. | AcceptDirectDeposit

CHAR(1) YesNo |

| Accept Direct Debit | Accept Direct Debits (vendor initiated) | Accept Direct Debit transactions. Direct Debits are initiated by the vendor who has permission to deduct amounts from the payee's account. | AcceptDirectDebit

CHAR(1) YesNo |

| Accept Electronic Check | Accept ECheck (Electronic Checks) | Indicates if EChecks are accepted | AcceptCheck

CHAR(1) YesNo |

| Accept ATM | Accept Bank ATM Card | Indicates if Bank ATM Cards are accepted | AcceptATM

CHAR(1) YesNo |

| Minimum Amt | Minumum Amout in Document Currency | MinimumAmt

NUMBER Amount | |

| Only Currency | Restrict accepting only this currency | The Only Currency field indicates that this bank account accepts only the currency identified here. | C_Currency_ID

NUMBER(10) TableDir |

| Require CreditCard Verification Code | Require 3/4 digit Credit Verification Code | The Require CC Verification checkbox indicates if this bank accounts requires a verification number for credit card transactions. | RequireVV

CHAR(1) YesNo |

| Sequence | Document Sequence | The Sequence defines the numbering sequence to be used for documents. | AD_Sequence_ID

NUMBER(10) Table |

| Payment Processor Class | Payment Processor Java Class | Payment Processor class identifies the Java class used to process payments extending the org.compiere.model.PaymentProcessor class. Example implementations are Optimal Payments: org.compiere.model.PP_Optimal or Verisign: org.compiere.model.PP_PayFlowPro |

PayProcessorClass

NVARCHAR2(60) String |

| Commission % | Commission stated as a percentage | The Commission indicates (as a percentage) the commission to be paid. | Commission

NUMBER Number |

| Cost per transaction | Fixed cost per transaction | The Cost per Transaction indicates the fixed cost per to be charged per transaction. | CostPerTrx

NUMBER CostsPrices |

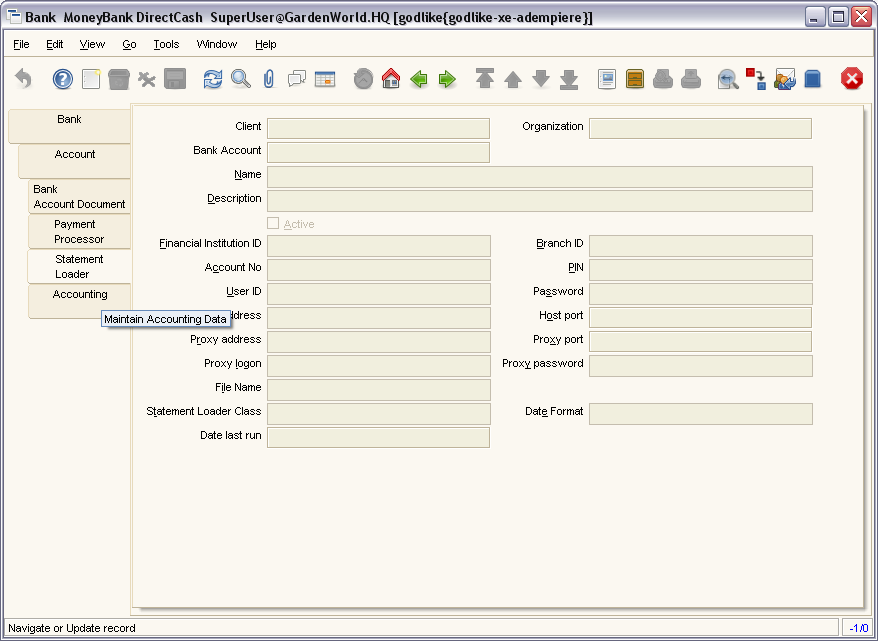

Tab: Statement Loader

Description : Definition of Bank Statement Loader (SWIFT, OFX)

Help : The loader definition privides the parameters to load bank statements from EFT formats like SWIFT (MT940) or OFX. The required parameters depend on the actual statement loader class

Table Name : C_BankStatementLoader

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Bank Account | Account at the Bank | The Bank Account identifies an account at this Bank. | C_BankAccount_ID

NUMBER(10) TableDir |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name

NVARCHAR2(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Financial Institution ID | The ID of the Financial Institution / Bank | Depending on the loader, it might require a ID of the financial institution | FinancialInstitutionID

NVARCHAR2(20) String |

| Branch ID | Bank Branch ID | Dependent on the loader, you may have to provide a bank branch ID | BranchID

NVARCHAR2(20) String |

| Account No | Account Number | The Account Number indicates the Number assigned to this bank account. | AccountNo

NVARCHAR2(20) String |

| PIN | Personal Identification Number | PIN

NVARCHAR2(20) String | |

| User ID | User ID or account number | The User ID identifies a user and allows access to records or processes. | UserID

NVARCHAR2(60) String |

| Password | Password of any length (case sensitive) | The Password for this User. Passwords are required to identify authorized users. For Adempiere Users, you can change the password via the Process "Reset Password". | Password

NVARCHAR2(60) String |

| Host Address | Host Address URL or DNS | The Host Address identifies the URL or DNS of the target host | HostAddress

NVARCHAR2(60) String |

| Host port | Host Communication Port | The Host Port identifies the port to communicate with the host. | HostPort

NUMBER(10) Integer |

| Proxy address | Address of your proxy server | The Proxy Address must be defined if you must pass through a firewall to access your payment processor. | ProxyAddress

NVARCHAR2(60) String |

| Proxy port | Port of your proxy server | The Proxy Port identifies the port of your proxy server. | ProxyPort

NUMBER(10) Integer |

| Proxy logon | Logon of your proxy server | The Proxy Logon identifies the Logon ID for your proxy server. | ProxyLogon

NVARCHAR2(60) String |

| Proxy password | Password of your proxy server | The Proxy Password identifies the password for your proxy server. | ProxyPassword

NVARCHAR2(60) String |

| File Name | Name of the local file or URL | Name of a file in the local directory space - or URL (file://.., http://.., ftp://..) | FileName

NVARCHAR2(120) String |

| Statement Loader Class | Class name of the bank statement loader | The name of the actual bank statement loader implementing the interface org.compiere.impexp.BankStatementLoaderInterface | StmtLoaderClass

NVARCHAR2(60) String |

| Date Format | Date format used in the imput format | The date format is usually detected, but sometimes need to be defined. | DateFormat

NVARCHAR2(20) String |

| Date last run | Date the process was last run. | The Date Last Run indicates the last time that a process was run. | DateLastRun

DATE DateTime |

Tab: Accounting

Description : Maintain Accounting Data

Help : The Accounting Tab is used to define the accounts used for transactions with this Bank.

Table Name : C_BankAccount_Acct

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Bank Account | Account at the Bank | The Bank Account identifies an account at this Bank. | C_BankAccount_ID

NUMBER(10) TableDir |

| Accounting Schema | Rules for accounting | An Accounting Schema defines the rules used in accounting such as costing method, currency and calendar | C_AcctSchema_ID

NUMBER(10) TableDir |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Bank Asset | Bank Asset Account | The Bank Asset Account identifies the account to be used for booking changes to the balance in this bank account | B_Asset_Acct

NUMBER(10) Account |

| Bank In Transit | Bank In Transit Account | The Bank in Transit Account identifies the account to be used for funds which are in transit. | B_InTransit_Acct

NUMBER(10) Account |

| Unallocated Cash | Unallocated Cash Clearing Account | Receipts not allocated to Invoices | B_UnallocatedCash_Acct

NUMBER(10) Account |

| Bank Unidentified Receipts | Bank Unidentified Receipts Account | The Bank Unidentified Receipts Account identifies the account to be used when recording receipts that can not be reconciled at the present time. | B_Unidentified_Acct

NUMBER(10) Account |

| Payment Selection | AP Payment Selection Clearing Account | B_PaymentSelect_Acct

NUMBER(10) Account | |

| Bank Expense | Bank Expense Account | The Bank Expense Account identifies the account to be used for recording charges or fees incurred from this Bank. | B_Expense_Acct

NUMBER(10) Account |

| Bank Interest Expense | Bank Interest Expense Account | The Bank Interest Expense Account identifies the account to be used for recording interest expenses. | B_InterestExp_Acct

NUMBER(10) Account |

| Bank Interest Revenue | Bank Interest Revenue Account | The Bank Interest Revenue Account identifies the account to be used for recording interest revenue from this Bank. | B_InterestRev_Acct

NUMBER(10) Account |

| Bank Revaluation Gain | Bank Revaluation Gain Account | The Bank Revaluation Gain Account identifies the account to be used for recording gains that are recognized when converting currencies. | B_RevaluationGain_Acct

NUMBER(10) Account |

| Bank Revaluation Loss | Bank Revaluation Loss Account | The Bank Revaluation Loss Account identifies the account to be used for recording losses that are recognized when converting currencies. | B_RevaluationLoss_Acct

NUMBER(10) Account |

| Bank Settlement Gain | Bank Settlement Gain Account | The Bank Settlement Gain account identifies the account to be used when recording a currency gain when the settlement and receipt currency are not the same. | B_SettlementGain_Acct

NUMBER(10) Account |

| Bank Settlement Loss | Bank Settlement Loss Account | The Bank Settlement loss account identifies the account to be used when recording a currency loss when the settlement and receipt currency are not the same. | B_SettlementLoss_Acct

NUMBER(10) Account |