Revenue Recognition

From ADempiere

This Wiki is read-only for reference purposes to avoid broken links.

The following is still a DRAFT document but I thought you might like a heads-up. The idea of Revenue Recognition was added 12 years ago by Jorg and then never implemented. Adaxa has now 99% implemented it for both Time and Event based recognition requirements. The following explains how the process works.

Option 1 - recognise revenue over a set number of months.

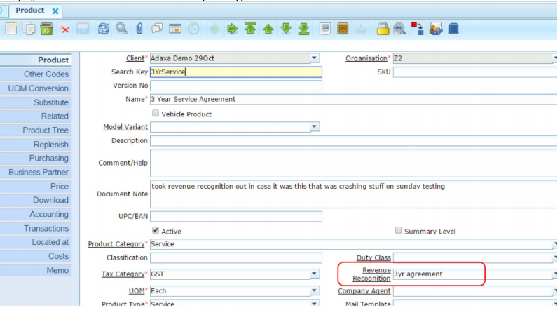

- The Product is linked to a “Revenue Recognition” type so revenue on sale is put in Customer Prepayments account in the invoice posting.

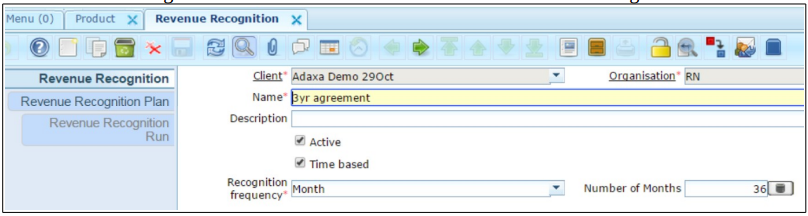

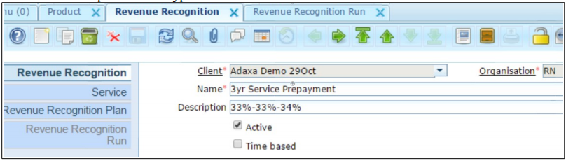

- The “Revenue Recognition” tab for a Time Based distribution defines the recognition rules.

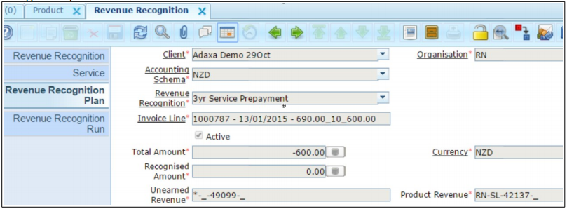

- The “Revenue Recognition Plan” tab shows the (many) invoices that have been raised that are linked to this plan

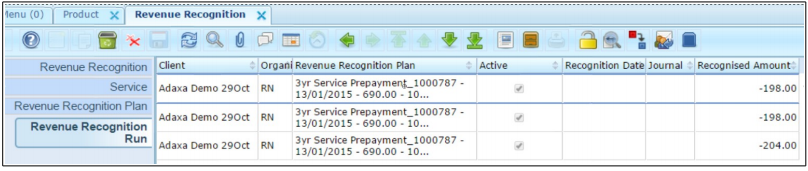

- The “Revenue Recognition Run” tab shows the planned amopunt of revenue to be recognised in each of the future months relating to a particular invoice.

- The journal column gets filled in when the revenue recognition happens and the appropriate accounting entries are created.

- A single line from above shown in form view shows a part of the invoice and when it was recognized and on what journal.

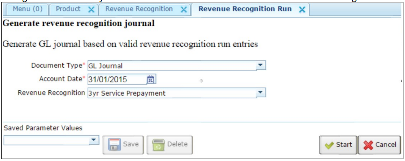

- The "Revenue Recognition Run" process creates a journal with lines that transfer from Customer Prepayment to income and records the journal line so you can drill to the journal line.

- The created journal picks up the revenue for each month from each invoice as per the Revenue Recognition Plan for that invoice.

Option 2 - Revenue Recognition based on an Event rather than time

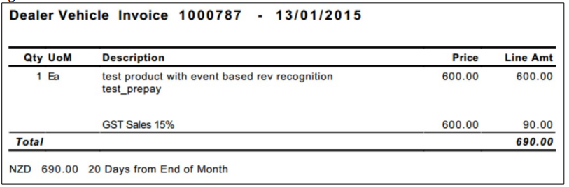

- Assume we have invoiced a service product and wish to recognise revenue over the life of the agreement.

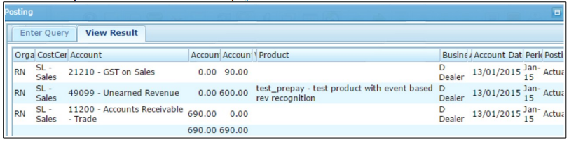

- The invoice posted to the Customere Prepayment/Unearned Reevenue account.

- The event-based plan for this type of sale is.

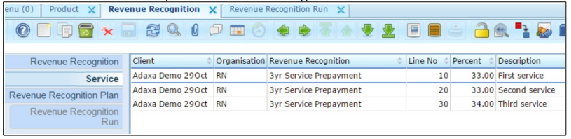

- The "Service" tab shows the percent that will be recognised at each event.

- The “Revenue Recognition Plan” tab shows the invoices that are to be handled by this revenue recognition plan…

- The “Revenue Recognition Run” tab shows the dollar amount to be taken up at each Plan Event for each invoice

- Enter a “Recognition Date” to record that the first of the three events has taken place.

- Run the process “Generate Revenue recognition lournal” and the system creates a GL journal that takes the revenue out of Customer Prepayments and credits Income for each line where a Recognition Date has been entered that is on or before the journal date. Each line in the Revenue Recognition Run has its journal line value inserted to show when and where it was recognised.

A report of Revenue Recognition Run lines where the Journal Entry field is null should match to the Customer Prepayaments/Unearned Income account in the Trial Balance.