ManPageW Withholding(1099)

Enjoy it, and help to fill it! But please, always respecting copyright.

Please write your contributions under the Contributions Section

Window: Withholding (1099)

Description : Maintain Withholding Certificates

Help : The Withholding Window defines the rule used for calculating withholding amounts.

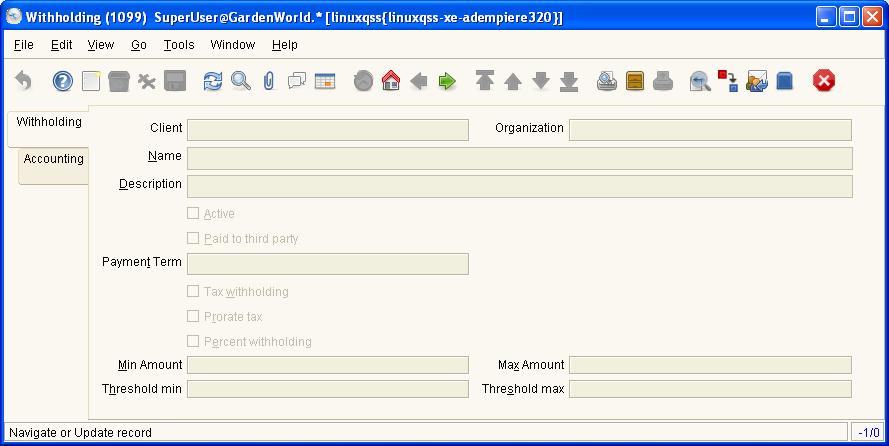

Tab: Withholding

Description : Withholding Rules

Help : The Withholding Rules Tab define the rules governing the withholding of amounts.

Table Name : C_Withholding

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name

NVARCHAR2(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Paid to third party | Amount paid to someone other than the Business Partner | The Paid to Third Party checkbox indicates that the amounts are paid to someone other than the Business Partner. | IsPaidTo3Party

CHAR(1) YesNo |

| Beneficiary | Business Partner to whom payment is made | The Beneficiary indicates the Business Partner to whom payment will be made. This field is only displayed if the Paid to Third Party checkbox is selected. | Beneficiary

NUMBER(10) Table |

| Payment Term | The terms of Payment (timing, discount) | Payment Terms identify the method and timing of payment. | C_PaymentTerm_ID

NUMBER(10) TableDir |

| Tax withholding | This is a tax related withholding | The Tax Withholding checkbox indicates if this withholding is tax related. | IsTaxWithholding

CHAR(1) YesNo |

| Prorate tax | Tax is Prorated | The Prorate Tax checkbox indicates if this tax is prorated. | IsTaxProrated

CHAR(1) YesNo |

| Percent withholding | Withholding amount is a percentage of the invoice amount | The Percent Withholding checkbox indicates if the withholding amount is a percentage of the invoice amount. | IsPercentWithholding

CHAR(1) YesNo |

| Fix amount | Fix amounted amount to be levied or paid | The Fixed Amount indicates a fixed amount to be levied or paid. | FixAmt

NUMBER Amount |

| Percent | Percentage | The Percent indicates the percentage used. | Percent

NUMBER Number |

| Min Amount | Minimum Amount in invoice currency | The Minimum amount indicates the minimum amount as stated in the currency of the invoice. | MinAmt

NUMBER Amount |

| Max Amount | Maximum Amount in invoice currency | The Maximum Amount indicates the maximum amount in invoice currency. | MaxAmt

NUMBER Amount |

| Threshold min | Minimum gross amount for withholding calculation | The Threshold Minimum indicates the minimum gross amount to be used in the withholding calculation. | Thresholdmin

NUMBER Amount |

| Threshold max | Maximum gross amount for withholding calculation (0=no limit) | The Threshold maximum indicates the maximum gross amount to be used in the withholding calculation . A value of 0 indicates there is no limit. | ThresholdMax

NUMBER Amount |

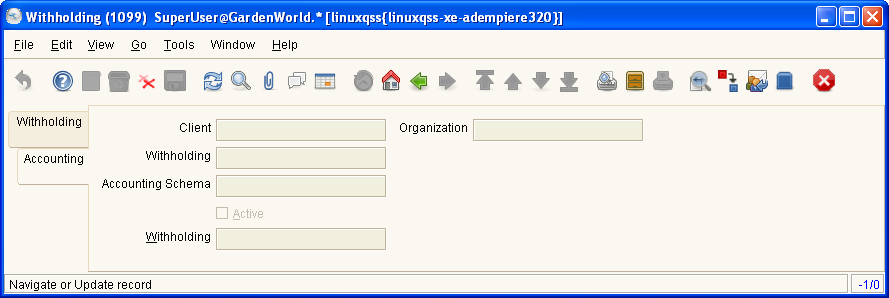

Tab: Accounting

Description : Withholding Accounting

Help : The Withholding Accounting Tab defines the accounting parameters for Withholding.

Table Name : C_Withholding_Acct

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Withholding | Withholding type defined | The Withholding indicates the type of withholding to be calculated. | C_Withholding_ID

NUMBER(10) TableDir |

| Accounting Schema | Rules for accounting | An Accounting Schema defines the rules used in accounting such as costing method, currency and calendar | C_AcctSchema_ID

NUMBER(10) TableDir |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Withholding | Account for Withholdings | The Withholding Account indicates the account used to record withholdings. | Withholding_Acct

NUMBER(10) Account |